Canadian Taxes: Which Province Charges Which Taxes & How Much?

| Province/Territory | Taxes Charged | Notes |

| British colombia | GST 5% & PST 7 % | As of April 1, 2013. |

| Alberta | GST 5% | |

| Saskatchewan | GST 5% & PST 5% | |

| Manitoba | GST 5% & PST 7% | |

| Ontario | HST 13% | |

| Quebec | GST 5% & QST 9.5%(Quebec Sales Tax) | As of January 1, 2013, the QST rate will be 9.975%, but will no longer be charged on GST. This results in no change to the total tax. |

| New Brunswick | HST 13% | |

| Nova Scotia | HST 15% | |

| Newfoundland & Labrador | HST 13% | |

| Prince Edward Island | HST 14% | As of April 1, 2013. |

| Northwest Territories | GST 5% | |

| Nunavut | GST 5% | |

| Yukon | GST 5% |

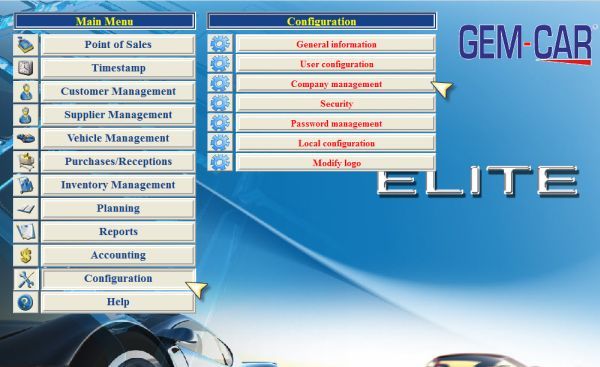

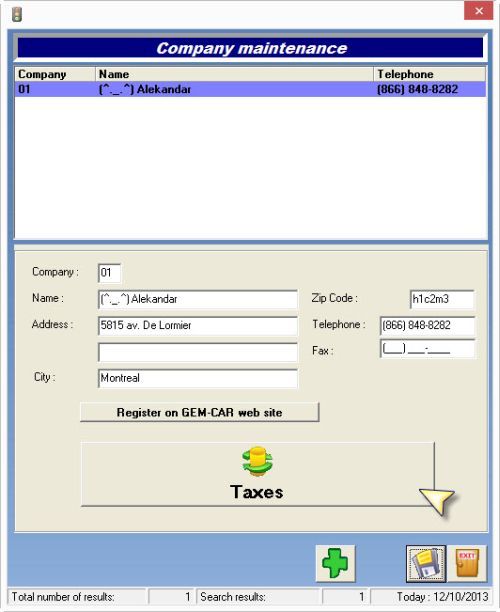

The taxes are usually configured along with the initial configuration of GEM-CAR. If you need to change this information you can go to:

- "Configuration" / "Company management",

- Click on the button : "Taxes".

Click here to ask for a free demo

Click here to ask for a free demo